Rahul Gandhi has announced that if Congress comes to power, it will transfer a certain amount of money to poor families and now, MIT economist Abhijit Banerjee is peddling a dangerous idea to justify it.

The exact amount is not certain: sometimes he has said that it will be Rs 72000 a year and sometimes he has said it will be Rs 72000 a month. At times it has been said that the government will “top up” the income of the poorest by paying the difference as “minimum income support”. At other times it has been called a flat transfer of a certain amount of money, which has again varied from Rs 72000 a month to Rs 72000 a year.

We don’t know. But now it seems increasingly clear why a deliberate cloud of misinformation has been created around this scheme. Possibly so that it becomes impossible to crunch the numbers and realize just how astronomical the cost of this scheme would be.

But yesterday, MIT economist Abhijit Banerjee who is advising Rahul Gandhi on his Minimum Income Scheme spilled the proverbial beans when he explained where the money would come from:

Nothing’s viable without raising taxes: Abhijit Banerjee, Economist (NYAY Advisor) while speaking to @RShivshankar | #NyayKaSach pic.twitter.com/AdZSGQFmVd

— TIMES NOW (@TimesNow) March 29, 2019

The two clear statements made by Abhijit Banerjee in this chilling video:

— There will be a need to raise taxes

— There will be a need to cause price rise (what he calls the “inflation tax”)

Let’s dissect both. First the matter of price rise, which Abhijit Banerjee charmingly calls the “inflation tax”.

For example, in the year 2013, India’s inflation rate was a staggering 10.9% (click here for World Bank data on India’s inflation rates since 1960).

This searing inflation rate meant that stuff was getting costlier by 10.9% every year. The thing with inflation is that everyone, right from the poorest person was paying this extreme inflation tax. Everything from detergent to toothpaste to vegetables.

In fact, food inflation in India averaged a staggering 11% between 2007 and 2013. This is how Dr. Singh’s government squeezed India’s poorest to a pulp, making their daily bread costlier by 11% every year!

At present India’s inflation is down to just 2-3% a year. Easy for Rahul’s US based adviser to go on Times Now and announce to India’s poor that they should be eating inflation rather than food.

Think about what double digit inflation did to people in 2013. Those at the margins of society were paying more for their food everyday. Those who had a little bit of savings kept them in banks which paid an interest rate of 4%. With the inflation at 11%, this meant their savings were actually decreasing by roughly 7% a year. Those with slightly higher savings could get 9% or so on their fixed deposits, which still meant a decrease of roughly 2% a year.

Think about how ironic that sounds: You put your hard earned money in the bank and every year around 7% of your money just vanishes into thin air. This means that if you put Rs 1000 for safekeeping in a bank account when Dr. Singh began his term in 2004, after 10 years, when Dr. Singh left office, you would have the equivalent of a little less than Rs 500. How would do you like that?

Think about what an 11% inflation rate does to senior citizens whose earning years are behind them and who have to subsist on their lifetime savings.

Now let’s talk about raising taxes. A lot of people who watched the video yesterday thought he was simply talking about raising income taxes. But Rahul’s Adviser on Minimum Income never said anything about which taxes he would raise.

This means, first of all, that apart from Income Tax, raising the GST rates is very much on the table. This also ties up very nicely with what Rahul Gandhi has been saying all along.

A single rate for GST. This number is usually believed to be 18%.

Which means that items which are currently in 0%, 5% or 12% bracket would all be moved into the higher 18% bracket.

Keep in mind that it is the items of everyday use which are commonly in these low 0%, 5% and 12% brackets. The items that even the poorest of the poor would need, starting right from food. In fact, most staples like rice and wheat are in the 0% GST bracket, which means we are looking right away at an 18% rise in the cost of rice and wheat.

Ironically, the gainers here would be the super rich: luxury items which are taxed at 28% would go down to 18%. If Rahul wants to avoid the appearance of that, he will have to raise everything to the single slab of 28%. That’s a 28% rise in the cost of rice and rotis. As Abhijit Banerjee would probably say, let them eat inflation.

Now let us come to the Income Tax. Because India has been deliberately kept poor for decades, very few people earn enough to pay income tax. This makes it politically easier for politicians to announce income tax hikes. But remember, it is the spending of the middle class that ultimately drives the economy.

What happens to the economy if the price of everything goes up by 11% and then the spending power of the middle class is cut down even more with punishing tax increases?

Let’s talk numbers. How much income tax are we talking?

This is easy. All we need to do is go back to the time when Indira Gandhi promised Gareebi Hatao in 1971, a promise that Rahul has renewed after 48 years.

A 97% top income tax rate! Phew!

And the inflation, how much would that be?

Brace for impact. Let me tell you the inflation rate in 1974: It was 28.6%

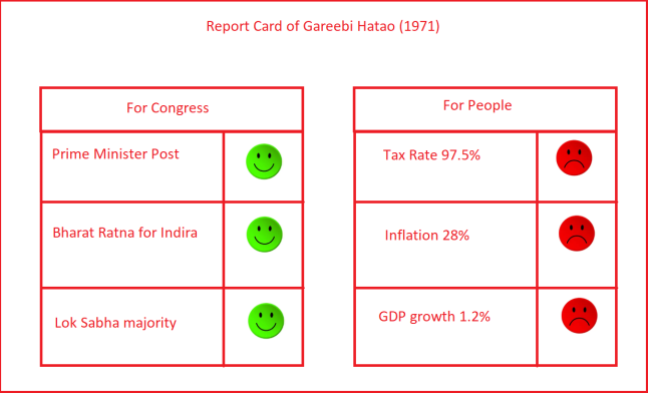

How would you like a 97% top income tax rate and a 28.6% inflation rate?

And how was the GDP growth doing? In 1974, it was a pathetic 1.2%.

Three years after Indira Gandhi’s ‘Gareebi Hatao’ began in 1971, India had a 97% tax rate, 28% inflation and 1.2% GDP growth rate.

How did Indira Gandhi get this under control? By bringing in the Emergency, of course, in 1975.

Four decades after Gareebi Hatao gave us 28% inflation and culminated in Emergency, the promise is being renewed.

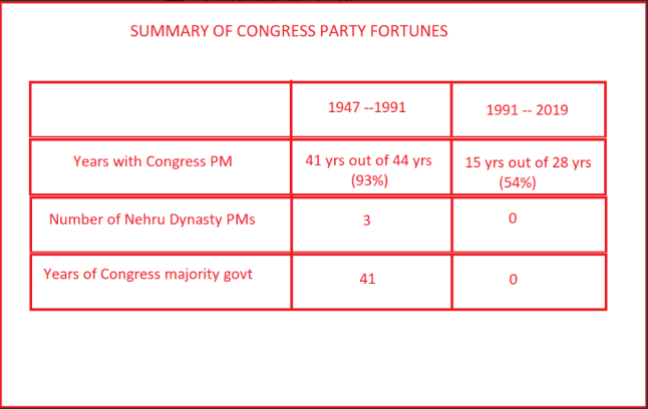

One could say it is now “impossible” for India to slip back into the 1970s, but is it? Consider this chart of Congress Party fortunes before and after 1991 economic reforms:

If you are a Dynast of the Nehru-Gandhi clan, what is the optimal strategy? Which side of history would you like to push India into? The pre-1991 period or the post-1991 period?

Here is the report card of Gareebi Hatao 1971 from two different perspectives: that of the Congress Party and that of the people.

Remember this when you vote.