So I read very carefully the interview that Finance Minister Nirmala Sitharaman gave to the Hindustan Times.

It is never a good sign when government ministers sound subtly apologetic about their own policies. By that I am not referring to the headline that Hindustan Times chose, which clearly refers to the $5 trillion target.

Indeed, the $5 trillion target is quite achievable, with 8% growth and 3% inflation. Sure, growth could slip a bit … say to 7% at which point the RBI and the govt will let inflation go up to say 4%, keeping the nominal GDP growth the same. From what I have read, the arithmetic says that this way we get to $5 trillion in FY 2024-25, which isn’t exactly the same as 2024. But it is close enough for the Modi government to claim victory on this front during the 2024 General Election.

By subtly apologetic, I am referring to this terse response from the Finance Minister at the end of her interview.

Wow! That response is “not ideal” at all. It sounds like something that Nehruvian era babus would say with a sigh, sitting behind a stack of dusty files, holding a dirty teacup in one hand, even as they contemplate ways to send their kids to America.

Assuming that HT transcribed her words perfectly, the very fact that the Finance Minister used “ideally” twice while starting two successive sentences, reveals a sort of helplessness.

There is always a proper time to cut taxes. The best time is the budget. The second best time is right NOW.

This response likely reveals that the top tax rate of 42.7% has become an embarrassing headline for the government. More than an embarrassment, it truly and deeply affects investor sentiment and business confidence. Now is the time to roll it back. By even the government’s own estimate, the money that would be mopped up is a pittance.

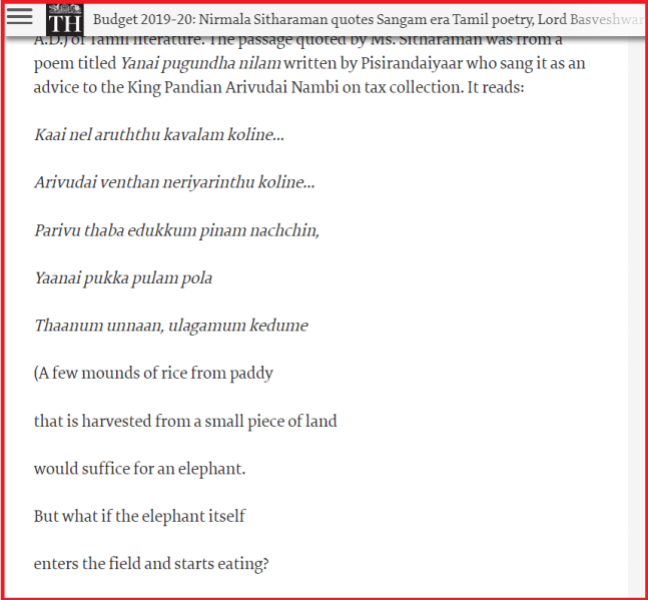

I found the same attitude of Nirmala Sitharaman during her budget speech, where she presented this absolutely wonderful piece of wisdom from Tamil Sangam literature.

Advice to the king that the government is like an elephant that can survive on few mounds of rice harvested from the field. But when the elephant enters the paddy field, everything is destroyed.

What a beautiful metaphor explaining that the economy flourishes when government intervention is kept to an absolute minimum. That’s Milton Friedman and ideas of the so called “Austrian school” of Economics almost 2000 years before there was an Austrian school of Economics. Or an Austria, for that matter.

But, sadly, the rest of the taxation proposals hardly kept up with the spirit of these 2000 year old words of wisdom. The corporate tax rate cut was good, but drowned in the negativity surrounding the new 42.7% top tax rate.

A similar sort of apologetic sounding theme appears in the words of Finance Secretary Subhash Garg.

As a bureaucrat, Garg does not make policy, he merely implements it. But you can see how he suggests alternatives to people who are looking to get out of the tax on buybacks. And points out that grandfathering some of the gains can be “discussed” with the Revenue Department.

It is worth noting that these words were said at a CII meeting on Budget discussion. Why do I get the feeling that the Finance Secretary is unable to look industry captains in the eye?

This is the time to rollback all those new taxes introduced in the budget. To get those favorable global headlines back.

Now, to be fair, the Finance Minister is mostly right when she says that negative sentiments over the Indian economy are mostly a domestic feature. India does remain the world’s fastest growing economy. Especially with Chinese growth down to historic lows. So we in India can bask in the glory of being the only game in town. Where would the global investors go, if not to India?

But the problem with that is the US economy is doing magnificently well. The global investors can just go home!

It is easy to see where the government is caught in a trap. On the one end, it has a very classic right wing approach to fiscal prudence. It insists on keeping the fiscal deficit to an absolute minimum. It is good that Nirmala Sitharaman brought up the FRBM (Fiscal Responsibility and Budgetary Management) Act. The FRBM was one of the many great economic legacies of the Vajpayee government, which required the Government of India to bring fiscal deficit under 3% of GDP. In fact, India’s economic problems in the UPA era began the day the UPA government decided to throw this law to the winds.

Since money is finite, there are only two ways to keep the fiscal deficit down. Either raise more money in taxes or cut government spending. In India, cutting welfare spending can hurt people who are the most vulnerable. So the focus should be on eliminating inefficiencies, leakage and corruption in the delivery of those schemes. The government has gone as far as it could on this: linking everything to Aadhaar and Direct Benefits Transfer proved to be the answer.

The government now feels that in order to maintain/reduce the fiscal deficit, there is nowhere to go except raise taxes. The problem with such thinking is that it is heavily counterproductive. Because high taxes lead to lesser investment, shrinking the pie and ultimately lower revenues at the end of the day. And in the Indian context, tax evasion as well. Now the government may feel they have the will to curb high level corruption and stop tax evasion. But what do you do about the much deeper problem of high taxation dissuading investors, becoming a crushing weight for private business?

It is time for Nirmala Sitharaman to listen to the 2000 year old words of wisdom she herself quoted from ancient Tamil Sangam literature.