It’s July 1, 2019. Exactly two years since India’s tax system was completely overhauled and replaced with the Goods and Services Tax (GST) on July 1, 2017.

The 2019 election set many historic ‘firsts’ at the domestic level: after all, this is the first time in decades that a full majority government served out a full term and got re-elected with another full majority. When did that happen the last time? Under Nehru in 1962!

But one of the most stunning (and relatively unnoticed) feats was a global ‘first.’

Indian Prime Ministers had been toying with the idea of GST for a very long time. But there was a reason they kept backing away. Because GST is the electoral equivalent of ‘bad luck charm.’ No government anywhere gets reelected after implementing GST.

The reasons are not difficult to understand. Overhauling the entire tax system creates tremendous short term pain. And whichever government is in power faces the brunt of public anger. Obviously, GST is a long term investment in the economic future by getting rid of a thicket of central, state and local taxes. But elections always happen in the short term.

Add to it the diverse, chaotic and hyper-competitive Indian political scene and you begin to see the enormity of the GST challenge. Not only does GST threaten revenue collection of the Central Govt, but it also puts the autonomy of state governments on the line. These problems assume bitter regional dimensions when you look at richer Southern and Western states versus the poorer states in the North and East.

It takes a brave man to put his mandate on the line over the GST bet, knowing that nobody else has won that bet before.

The GST challenge can be broken down into three parts

(1) The first was simply generating the political consensus around GST

A Constitutional Amendment would be required. Two-thirds majority in both houses of Parliament and ratification by at least half the states. How difficult is that when you have an opposition determined to block ‘everything’ and calculates that it has nothing to lose?

The miracle here was the creation of the unique body called the GST Council. How the council works is a marvel that is rarely ever explained.

The Council consists of representatives of the Center as well as the states. But here is how the voting powers break down:

Center : 1/3rd of the vote

States: 2/3rd of the vote

The first question here is which state gets how much vote? Well, every state gets the exact same number of votes! No matter how big, how small, how rich or how poor.

Imagine the political skill that went into creating a consensus like this across state governments. Imagine the hornet’s nest of political egos, regional chauvinism and old rivalries that had to be overcome for this.

Observe also the strategic climbdown for the Center to just 1/3rd of the votes, making the states feel that the Center was not looking down on them. You realize how little power the Center kept for itself when you learn that the GST Council can only take a decision if 75% of the votes are in favour.

So the Center (with 33% vote) effectively has veto power in the GST Council which needs at least 75% to agree on any decision. But not much more. In order to reach the magic figure of 75%, the Center must take 18 of the 29 states along or it won’t get its way.

On a side note, perhaps you can now see why it was so important for Modi to have NEDA governments in North Eastern states, no matter how tiny. The GST Council is where the real action is.

Over the last two years, this miracle called the GST Council has been managed so smoothly that its inner workings have rarely made news. Building this council was a balancing act with no parallel in recent history.

(2) The second challenge was to manage the short term economic pain after GST

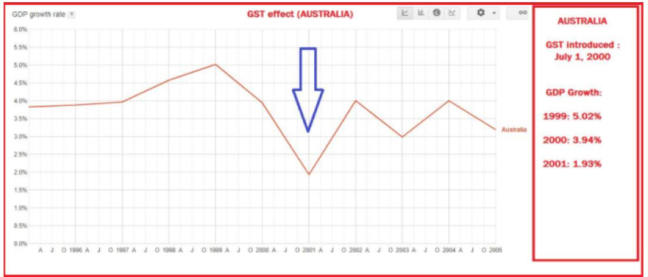

Here are two charts, showing what happened to GDP growth when Australia and Canada tried to implement GST.

See the plunge that GST caused! Now let us put in context the challenges in India versus a first world country like Australia or Canada. More people live in Delhi than in any of these countries!

The first thing India did was to adjust to the realities of our economy. Instead of a true GST with a single rate, India went for 5 brackets: 5%, 12%, 18%, 28% and 35%. Lots of basic food items, etc were put in the 0% bracket and you could call it the sixth slab of GST if you want.

It’s less than ideal, but surely a mega improvement on the previous system of every item having at least 3 taxes on it: Central, State and Local. If you are lucky. In addition to VAT, service taxes, etc, etc, etc. The old system had literally hundreds of different tax rates on various items. Now, anybody could remember the sequence 5%, 12%, 18%, 28% and 35%.

When GST was implemented, the fears were many. Government revenue could have dropped precipitously. The onus was on the government to ensure compliance and manage the anger of people trying to adjust to the new system. Without choking the economy completely as had happened in every other country.

But none of the fears came true. India’s economy slowed down, but it still remained the fastest growing in the world. GST compliance burden was reduced from monthly filings to quarterly filings that most businesses would already have been familiar with. Items were constantly moved into lower and lower tax brackets (the 35% bracket is now almost empty), but total tax collection kept growing at a healthy pace.

(3) The third challenge was to handle the political fallout of GST

When GST was launched on July 1, 2017, PM Modi graciously invited all ex-Prime Ministers to be present by his side, reflecting the consensus around the passage of the GST bill and the non-partisan nature of the GST Council.

But in a characteristically cowardly move, Dr Manmohan Singh declined the invitation. The Congress was making it clear that GST would be Modi’s tax. And he would be on the line for all the immediate inconvenience that would follow. And as India’s economy shut down for a month before and after July 1, 2017 to adjust to the new regime, the Congress made the most of the low GDP numbers. Before the crucial Gujarat election.

Who remembers that Sonia ji’s UPA government had said India was ready for GST already in 2010? Nobody. You know it was Chidambaram who had set Apr 1, 2010 as the GST deadline. But, suddenly in the summer of 2017, Congress and its entire ecosystem told us that GST is “premature.”

Modi was on his own to handle the fallout. The fact that people stuck by him is a historic masterclass in leadership. In July 2017, the election was less than 2 years away. He showed confidence in the people. And the people in turn showed confidence in him.

People rarely listen to government assurances when they are hit in the pocketbook. Modi had to ensure those hits were kept to an absolute minimum and make people believe he was doing his absolute best.

The GST isn’t perfect yet, but it’s getting there. As I mentioned before, the top slab of 35% is now almost gone and the 28% slab is gradually getting hollowed out as well. Three things: fuel, real estate and alcohol are still outside GST.

The biggest takeaway here is that India and Modi sarkar survived an economic and political storm like no other. And came out relatively unscathed. Here’s to the Ease of Doing Business!