Finance Minister Nirmala Sitharaman presented the Union Budget for the financial year 2019-2020. Here are the key numbers and charts of the budget.

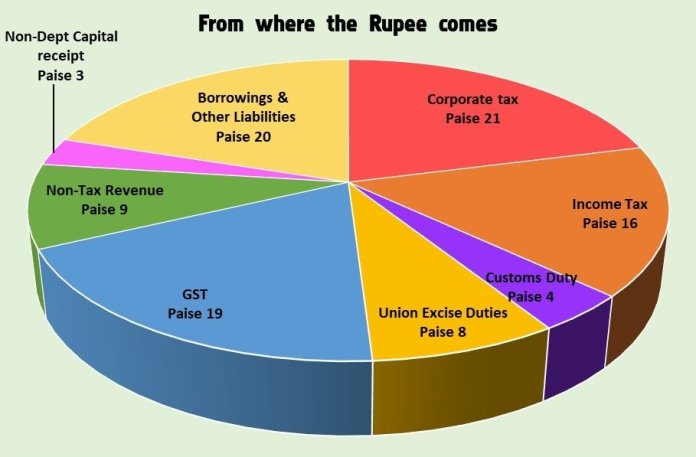

The receipts of the central government are more or less evenly distributed among various heads. Corporate tax, Income tax and Goods and Service Tax provide 21%, 16% and 19% respectively. Borrowings and other liabilities contribute 20% of the government’s receipts.

Where the Rupee goesThe largest share of the government’s outgo is states’ share of taxes and duties, which has increased significantly due to the implementation of GST. After that, the major expenditure goes towards interest payment. Defence, central sector schemes and centrally sponsored schemes, subsidies are the major expenditures.

Here is the budget allocation for various departments and sectors:

Allocation of Budget (in Rs crore)

After interest payment and defence, the two largest expenditure heads are food subsidy and pension. Transport occupies the fifth position, given the emphasis of the Modi government on infrastructure development. Agriculture and allied activities have seen the highest increased in the budget of 75%, from 86.6 thousand crores to 1.52 lakh crores. Tax administration has seen 74% increase, as this head includes the transfer to GST compensation fund. Budget for IT and Telecom has gone up by 34%.

Two sectors that have seen a reduction in budget estimates are Energy and Commerce and Industry, which have gone down by 3% and 5% respectively.