The inspiration for this article came from a rather unusual corner.

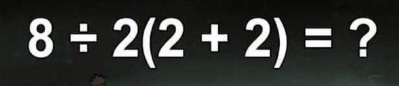

This “math problem” posted online has gone viral, leading to thousands of comments and arguments. And the internet being the internet, things soon got personal, with insults about gender, about who has what level of education and other unrelated matters.

The real problem here is that the question is not clear. Why not use more brackets to make clear what is being asked, whether (8/2)(2+2) or 8/(2(2+2))?

The purpose of notation and symbols is to convey information clearly. Not to become puzzles in themselves.

The ancient Romans had different symbols for different numbers: “V” was five, “X” was ten, “L” was fifty and “C” was a hundred and “D” was five hundred. The bigger the numbers you wanted to write, the more symbols you had to invent.

The ancient Hindus had a better idea. They used the place value system, which allowed any number, no matter how large, to be written uniquely in terms of just 10 symbols. It reduced the memorization load and increased clarity. And it made it easier to frame simple rules for addition and multiplication. In contrast, if you use the Roman system, what’s “L + C”? See how opaque. When you use the superior Hindu place value system, the reduced notation load frees up your mind to see wider mathematical horizons. And then you can actually *grow* the subject.

Now you see what was wrong with the viral “math problem” that HT posted. People thought they were debating the correct answer. When in reality, they were actually debating the question. The question was not clear because its meaning depended on some set of rules that are difficult to remember and vague in their interpretation.

And that’s a total waste of human effort.

How is all of this connected to the shocking case of Cafe Coffee Day owner V G Siddhartha committing suicide?

The late owner has left behind a letter, which has gone viral as well. In that, he explains that he had problems paying back loans and had faced harassment from the Income Tax Department. Critics have jumped on the government, accusing it of “tax terrorism.” Others claim that the IT raids on him did uncover undisclosed income. Do they ask if the government is supposed to go easy when there is suspicion of tax evasion or financial fraud? Would that not lead to situations where people plunder the country and escape abroad?

So what is tax terrorism? How zealously is the government supposed to enforce the tax code? And what does that even mean? Is the government supposed to enforce half the code and forget the other half? Is 50% too much or too little? Should 90% of the code be enforced then? At what point does it go from merely enforcing the law to tax terrorism?

But then, if it appears that an entrepreneur who has created thousands of jobs is driven to suicide, surely the government has gone too far?

These arguments and counter-arguments are just as useless as those over the “math problem” mentioned above.

We think we are arguing about the answer when in reality we are not sure what the question was. A large business operates through a maze of financial instruments that nobody really understands. The business and its accountants would interpret it in one way. And the Income Tax Department would perhaps interpret it another way.

And none of us really knows who is right.

The important point here is that it’s not our fault that we don’t know. The problem lies with the fact that the tax code is way too complicated. It is a puzzle in itself.

Any time spent arguing over interpretations of the tax code is in itself a waste of human effort and an injustice.

And why should that be?

The answer here, as with the math problem, is to make the rules crystal clear, leaving no room for ambiguity.

Think about GST. There used to be a maze of different rates for each and every item from each and every authority: state, local or central. Now, any kid can remember:, 12, 18, 28.

This is why GST always helps the economy. When you reduce the compliance load, you free up the entrepreneur to do what really matters. And you can actually grow the economy.

On one hand, we complain about big business getting away with creative accounting and not paying their fair share in taxes. When the government tries to saddle them, it often goes too far, stifles the economy and then we complain again about tax terrorism.

But it is not often appreciated that both problems actually have their origin in a complicated tax code. Complicated tax code allows a clever accountant to find excuses not to pay taxes. Complicated tax code allows a power-drunk bureaucrat at the IT Department to find ways to trip you up.

And, with the bold exception of GST, the current government has made the tax code even harder to understand. More and newer slabs, taxes on new kinds of income, surcharges and cess and all kinds of stuff over and above that.

Would it not be easier if the tax to be paid could be determined on the back of an envelope? A single number, or if you must, maybe a sequence of 2-3 numbers that any kid could learn in primary school. You take the whole income, multiply it by this one rate and pay your tax. No exemptions on income. Nowhere for an unscrupulous person to hide. No way for a bureaucrat to challenge the calculation.

What would that do? It would free up entrepreneurs to use their energy elsewhere. With no hope of making gains through creative accounting, a business can spend its time on growing itself. This would create jobs. The government would no longer need a bloated bureaucracy to enforce rules that nobody understands. The government could actually pass these savings on to the poor and increase their spending power. That would lead to more customers for businesses. More jobs and more growth.

Isn’t that better?